Learn about the latest trends in the Hungarian property market, from rising rental yields to a decline in flat supply, and how they affect Hungarian property prices in the second part of a series of articles on the Hungarian housing market.

Rental yields in Budapest are moderately good, with Buda apartments outperforming Pest, and apartment rents are rising again. The main reason for the rent increase is a decrease in rental flat supply.

Despite rising interest rates, the Hungarian housing loan market is expanding, with more people purchasing homes with loans.

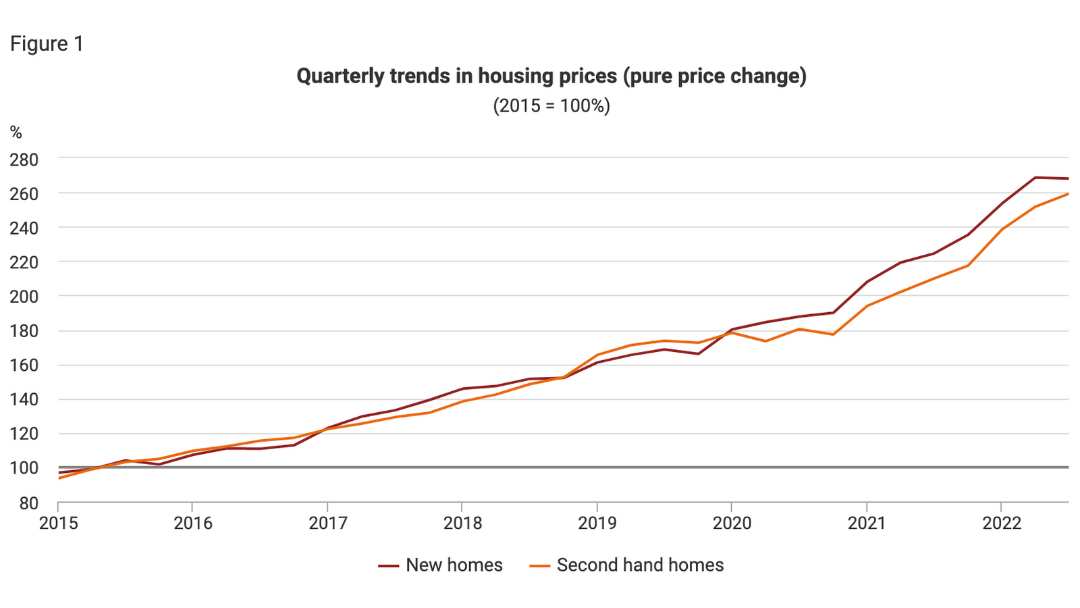

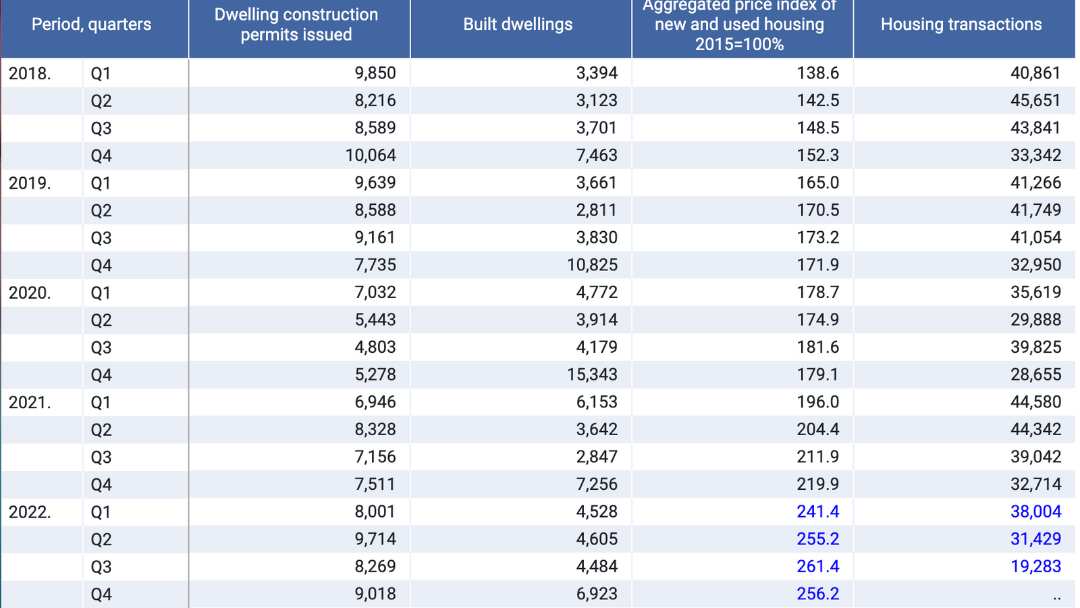

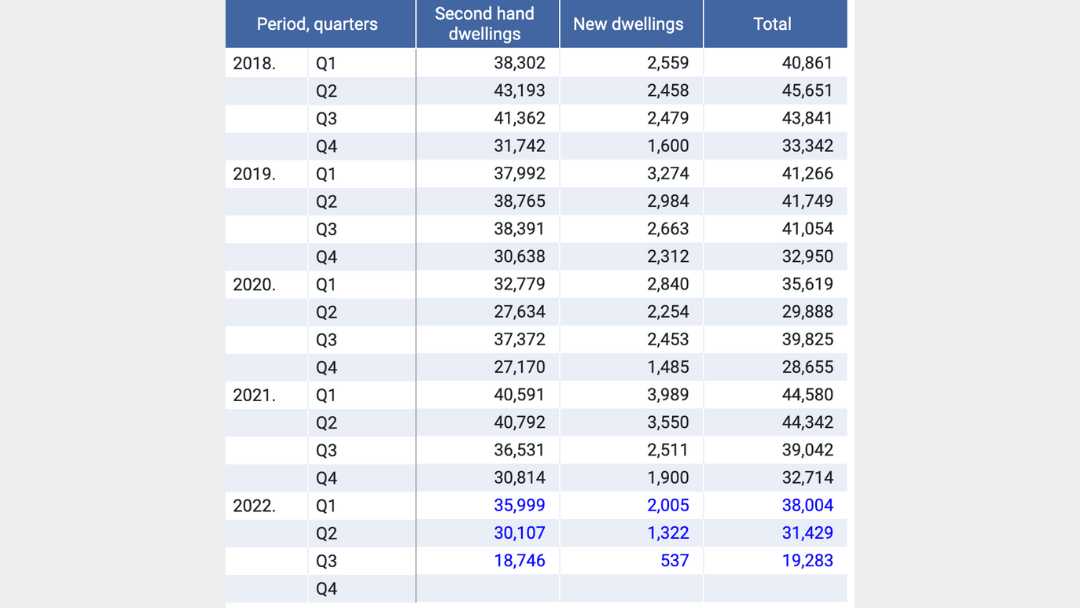

Number of housing transactions made by private persons by quarter years – source: KSH

Residential Construction Rise

The Hungarian property market surge has resulted in a sharp increase in residential construction, with almost half of the new supply being in Budapest and Pest. In 2020, the total number of newly built dwellings in Hungary rose 33.5% y-o-y to 28,208 units, despite the pandemic. However, in 2021, newly built dwellings fell by 29.5% y-o-y to 19,898 units due to rising material costs.

Budapest Rental Yields are Moderately Good with Rents Rising Again

The rental yields in Budapest are moderately good with the Hungarian property market rebounding from the decline due to travel restrictions and Airbnb regulations. Gross rental yields in Buda apartments are yielding higher returns than Pest.

The apartment rents in Budapest are on the rise again, particularly due to the decline in the supply of rental apartments.

Higher Yields in Buda, Lower in Pest

According to a Global Property Guide research, apartments in Buda have higher yields ranging from 5.63% for smaller-sized apartments of 90 sq. m. to 5.73% for larger apartments of 120 sq. m. In comparison, apartments in Pest have slightly lower rental yields ranging from 5.16% to 5.24%.

Rising Rents

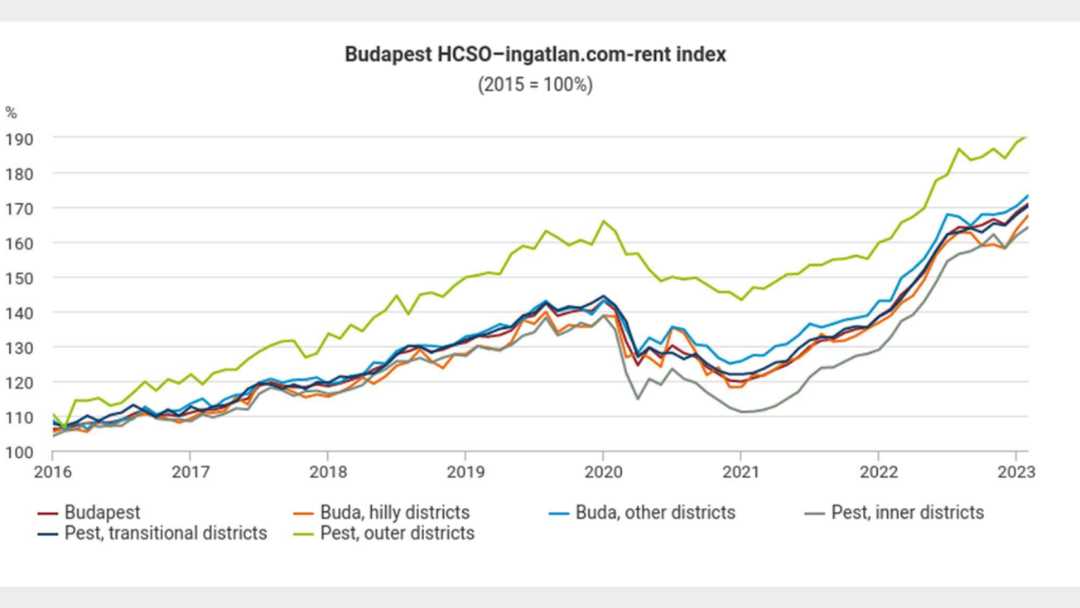

According to KSH-ingatlan.com rent index analysis, apartment rents in Hungary surged 23.4% YoY by end-Q2 2022, with rents in Budapest increasing 24% YoY over the same period. However, the longer-term data indicate a moderate rise in prices, with average rents rising by almost 66% nationally and 57% in the capital since 2015.

Decline in Rental Apartment Supply

The decline in rental apartment supply is the main reason for the surge in rents. The number of apartments for rent has dropped from 20,000 to just over 10,000, a 49% decline, in the past year, said László Balogh, the leading economic expert of ingatlan.com.

Rent Range in Budapest

The average monthly rents for brick apartments in Budapest range from HUF 125,000 (€294) to HUF 350,000 (€825). Districts 1, 2, 3, 5, 6 and 12 are among the most expensive areas while Districts 4 and 10 and the peripheral districts on the Pest side are the cheapest.

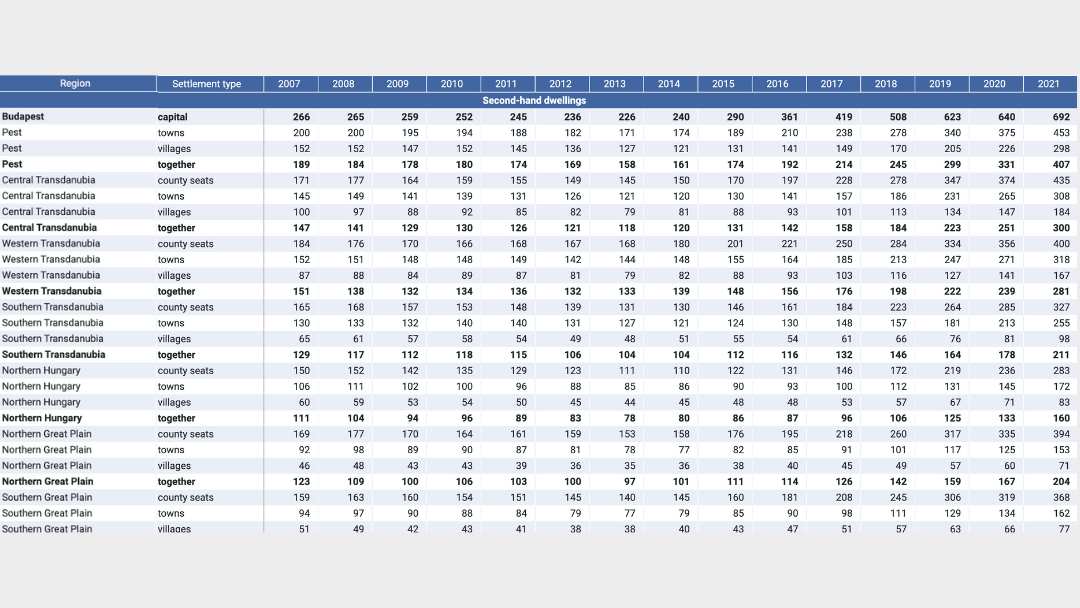

Source: KSH (Hungarian Central Statistical Office)

Interest Rates on the Rise

Despite the increasing interest rates, the Hungarian housing loan market is growing, with more people buying houses with loans. However, the size of the mortgage market remains small compared to GDP.

According to the European Central Bank, housing loan interest rates are beginning to rise, with the average interest rate on housing loans increasing to 4.83% in August 2022 from 4.49% in the previous year. As a result, this may have an impact on Hungarian property market in the near future.

Hungary Interest Rates

The average interest rates on loans for house purchases by initial rate fixation (IRF) in August 2022 were as follows:

- IRF of up to 1 year: 6.52%

- IRF over 1 year and up to 5 years: 4.7%

- IRF over 5 years: 4.83%

Mortgage Market Growing Strongly

The growth of Hungarian property market continues to drive the mortgage market, which is showing strong signs of expansion.

The value of new housing loans disbursed rose significantly by 36.2% to HUF 1.25 trillion (€2.94 billion) in 2021, and the total number of new housing loans disbursed increased 16.7% to 121,347 last year.

New Loans Disbursed

Hungarian property market have witnessed a significant rise in the number of new loans disbursed for buying second-hand homes, which surged by almost 35% y-o-y to HUF 857.8 billion (€2.02 billion), and loans for buying new homes rose strongly by 21.7% to HUF 135.61 billion (€319.4 million) last year.

Loans for housing construction rose slightly by 2.1% to HUF 80.4 billion (€189.3 million) last year, and loans for home renovation almost tripled to HUF 118.72 billion (€279.6 million) in 2021.

Reasons for Increased Loan Demand

Hungary’s relatively low interest rates and subsidized lending schemes, such as the Family Housing Subsidy Scheme (CSOK), have led to increased loan demand. The government’s newly introduced home improvement subsidy has also contributed to this.

Housing Loans Outstanding

The value of housing loans outstanding increased 15% to HUF 4.58 trillion (€10.8 billion) in 2021, and the share of “problem-free” loans slightly declined to 96%. The non-performing exposure ratio also increased to 3.7% last year.

The state of Hungary’s economy

Hungary’s economy has had a strong recovery since the pandemic, registering a real GDP growth rate of 7.1% in 2021, one of the fastest in the EU. In Q2 2022, the economy grew by 6.5% YoY, with all sectors contributing except agriculture.

However, the European Commission’s forecast expects the economy to slow down to 5.2% this year due to rising inflation, tightening fiscal and monetary policies, trade disruptions, and the situation in Ukraine and Russia. These factors may also strongly affect the Hungarian property market.

GDP Growth and Contributing Sectors

Hungary’s Finance Minister noted that Q2 growth was supported by all branches of the economy, particularly industry, trade, tourism, the financial sector, and ICT. Quarter-on-quarter, the economy expanded by 1% in Q2 after growing by 2.1% in the previous quarter.

Forecasted Slowdown in Economic Growth

While Hungary’s economy has been experiencing strong growth, it is expected to slow down due to various factors such as inflation, fiscal and monetary policies, trade disruptions, and uncertainty in Ukraine and Russia. As a result, the growth of the Hungarian property market is also expected to be impacted.

Unemployment and Inflation

Unemployment in Hungary is at a low of 3.4%, and the nationwide inflation rate in August 2022 rose to 15.6%, the highest since May 1998. The surge in inflation was due to a rise in food and other commodity prices, far above the central bank’s target range of 2% to 4%.