An Overview of the Hungarian Housing Market: House Prices Surge by 22.8%

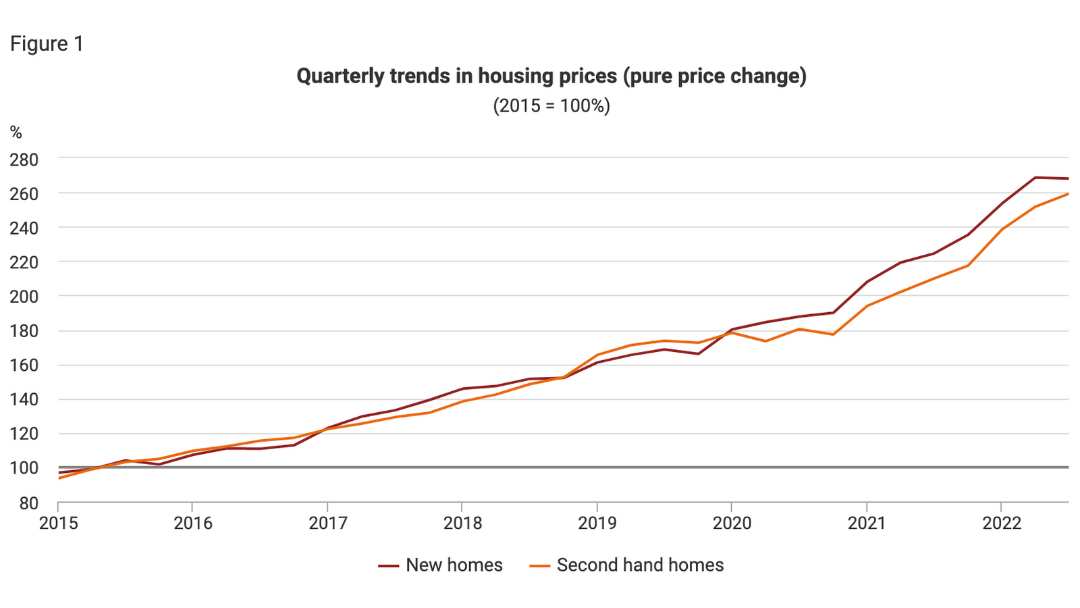

According to data from the Hungarian Central Statistical Office (KSH), Hungarian housing market saw a surge of 22.8% (11% inflation-adjusted) in Q2 2022, the highest annual price growth recorded in recent history.

The demand for homes has also risen after a decline in 2019-20, with the total number of second-hand homes sold increasing by 13.8% in 2021. Meanwhile, foreign demand has recovered due to the weakening of the forint against the euro.

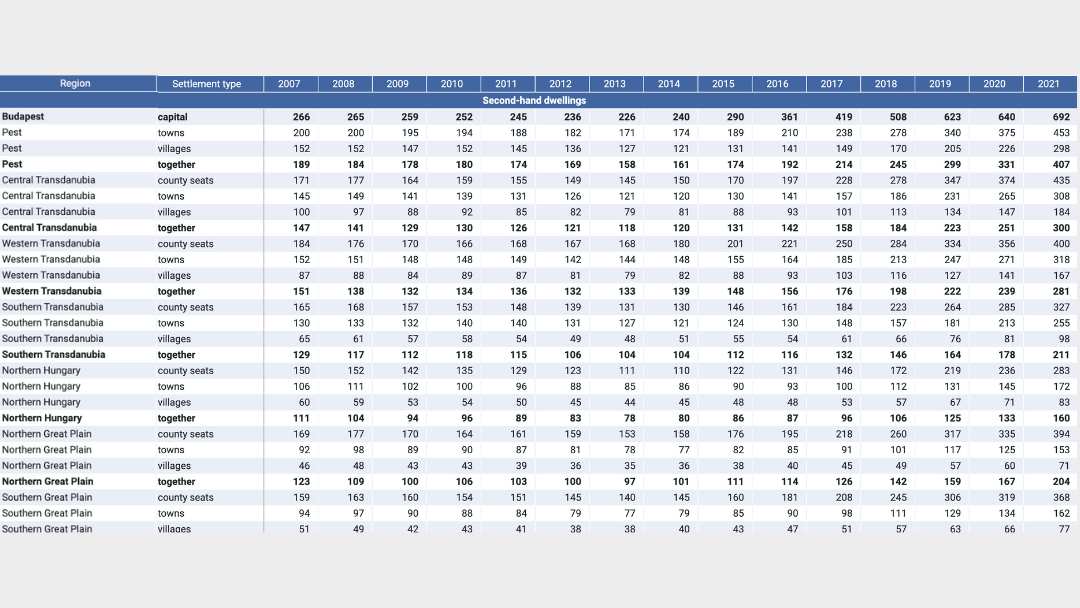

Regional Price Trends

Pest, the eastern part of Budapest, had the highest y-o-y increase of 33.7%, followed by Northern Great Plain, Northern Hungary, Southern Great Plain, Central Transdanubia, Southern Transdanubia, and Western Transdanubia. Budapest saw a more modest increase of 9.7% in the mean price of second-hand homes y-o-y.

Local House Price Variations

Budapest and Pest have the most expensive housing, with the average price of second-hand homes reaching HUF 39.7 million (€93,491) in 2021. Meanwhile, the Great Plain and North regions have the least expensive housing, with the average price standing at around HUF 11.7 million (€27,553) and HUF 14.3 million (€33,676), respectively.

Mean price per sqm by region and settlement type, source: KSH

Average Home Prices

In Q1 2021, the average price of new homes was HUF 45.6 million (€107,862), while second-hand homes averaged HUF 22.8 million (€53,931).

Hungarian Housing Market – trends in housing prices, source: KSH

Rising Demand

The demand for second-hand homes has bounced back strongly, with an annual increase of 13.8% in 2021. This is a significant improvement from declines of 14.3% in 2020 and 5.7% in 2019. Foreign demand is also on the rise due to the weakening of the forint against the euro.

Hungarian housing market continues to rise, with an increasing number of people looking to purchase homes, particularly in Budapest.

The number of second-hand homes sold rose by 13.8% to 142,138 units in 2021 from a year earlier, a significant improvement from annual declines in 2020 and 2019. Second-hand home sales increased in Central Hungary and Transdanubia by 12.8% and 15.6% year-on-year, respectively. In contrast, sales in Pest decreased by 25.4% in 2021.

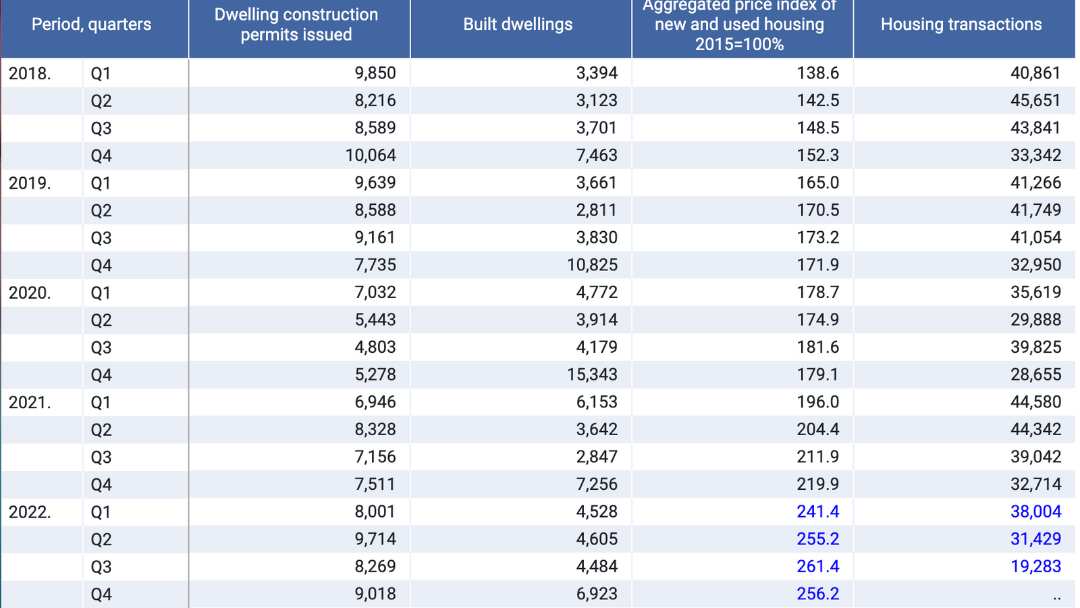

Source: KSH

Hungarian Housing Market: Weak Construction but Improving Demand

Despite a robust overall economy, Hungary’s residential construction activity remains weak. In the first half of 2021, housing completions fell by 6.8% year-on-year to 9,133 units, with a 16.8% drop in Central Hungary and a 1.9% drop in Great Plain and North. Newly built homes increased 21.6% year-on-year in Transdanubia.

Foreign Buyers Rising Again

In the first half of 2022, the number of foreigners interested in Hungarian residential properties rose by 10%, partly due to weakening domestic currency against the euro. The high concentration of foreign homebuyers in Budapest is one of the main reasons for the huge price difference between the city and the rest of the country, with foreigners spending on average over HUF 40 million (€94,195) on a home in Budapest.

Foreign Homebuyers in Hungary: Popular Locations and Legal Requirements

Hungary has been a popular destination for foreign property buyers in recent years, with Budapest being the most favored location. In fact, more than half of foreign property demand is in Budapest. District 7, 6, and 8 are the top three districts preferred by foreign homebuyers. Moreover, towns and villages in the counties around Lake Balaton also represent about 11% of foreign demand.

However, the Covid-19 pandemic has negatively impacted the foreign property market in Hungary. Home purchases by foreigners have significantly dropped due to travel restrictions. Before the pandemic, foreign homebuyers were on the rise.

From 2017 to 2019, the number of purchases increased from 3,207 to 3,753. Chinese citizens accounted for more than half of the total, followed by EU citizens, primarily Germans. Other large groups of buyers were Israelis, Russians, and Turks.

Hungarian law requires that real estate purchases be concluded through private contracts countersigned by a lawyer. Non-Hungarian citizens must obtain approval from the relevant Administrative Office to purchase property as a private person. The process usually takes 2-3 months.

To avoid this approval process, most lawyers advise foreign nationals to set up a company registered in Hungary to purchase property. This process takes only 1-2 days, and all expenses can be written off.

In conclusion, Hungary is a popular destination for foreign property buyers, particularly in Budapest and towns/villages around Lake Balaton. However, purchasing property in Hungary as a foreigner requires following legal requirements, and it is advisable to consult a lawyer for guidance.

Hungary’s Housing Cycle: From Crisis to Recovery

The Hungarian housing market has experienced a tumultuous cycle from crisis to recovery, with government measures playing a significant role in boosting demand. The COVID-19 pandemic has had an impact on the housing market, but it has quickly bounced back in 2021. As Hungary continues to recover, the housing market is likely to see further growth in the coming years.

The Hungarian housing market suffered a severe decline from 2008 to 2013, with house prices falling by 21% (36% inflation-adjusted) as a result of the 2009 global financial crisis and the forint’s steep decline that caused the mortgage market to collapse.

However, legislation in November 2014 required financial institutions to convert all outstanding foreign currency-denominated loans into HUF by December 2015, causing a sharp decrease in the stock of housing loans in foreign currency. House prices began to rise by 6.6% (7.3% inflation-adjusted) in 2014, and have been increasing annually by double-digits, surging by a total of 120% (99% inflation-adjusted) in 2014-19.

COVID-19 Impact on the Hungarian Housing Market

The housing market’s growth decelerated to 6.8% (3.9% inflation-adjusted) in 2020 due to the economic repercussions brought by the COVID-19 pandemic, the ensuing lockdown measures, and travel restrictions. However, the Hungarian housing market bounced back quickly in 2021, registering a house price increase of 21.4% (13.4% inflation-adjusted), as economic conditions gradually improve.

Government Measures Boost Demand

Part of the housing demand recovery during 2014-5 was due to other government measures. In 2013, the government increased the amount of 5-year loan subsidies, the maximum value of subsidized loans, and the loan house price threshold, resulting in significantly stronger credit demand in the second half of 2013.

In 2015, a non-refundable subsidy, the family housing allowance (CSOK), became available for buying new- and used homes, apartment expansions, and home construction. The program was expanded in 2018, allowing families returning from abroad and those owning a property to apply for the CSOK.

By end-2021, almost 192,000 families had benefited from the program, receiving a total of HUF 467.4 billion (€1.1 billion). Furthermore, every woman under the age of 40 is eligible for a CSOK interest-free loan when she first gets married. The government also repays HUF 1 million (€2,355) of mortgage loans for families with at least two children.